Whether you have an existing website or app backing your business or intend to invest in one, you want to provide your clients with a secure and efficient payment option.

According to statistics, the number of internet buyers in India will reach 220 million by 2025. A large number of these buyers choose to make online purchases using credit or debit cards and other similar payment methods.

One of the most important considerations in running an internet business is selecting the best payment gateway. A payment gateway is the core component in the payment processing system, regardless of whether you purchase online or in-store. It can help customers and businesses in an increasingly cashless environment where payment services are predominantly performed online or through credit cards.

Payment gateways are merchant services that accept credit card payments for eCommerce sites and traditional brick-and-mortar establishments. It is the front-end method within a transaction that collects, transports, and authorizes client information in real time to the trader’s bank, where the payment is processed.

Best Payment Gateways: In A Nutshell

Before we get into the details, here is a list of the top nine payment gateway providers, along with their key features and G2 rating:

| Sr. No | Gateway Provider | Key Feature | G2 Rating |

| 1. | Stripe Connect | Stripe provides a variety of standardized APIs and solutions that allow companies to accept and monitor online payments in real time. | 4.4/5 |

| 2. | PayPal | Using PayPal credit card processing, you can enable on-site customer payment for all the popular payment methods. | 4.4/5 |

| 3. | RazorPay | Razorpay supports all payment methods, including debit and credit cards, UPI, and major mobile wallets. | 4.2/5 |

| 4. | Paytm Business | Paytm Business provides payment solutions for various types of enterprises, from little tea shops to large multinational corporations. | 4.5/5 |

| 5. | Apple Pay | Apple’s payment gateway program enables retailers to accept payments using Touch ID and Face ID within a mobile payment framework. | 4.7/5 |

| 6. | Authorize.net | Authorize.net makes it simple to collect digital and credit card transactions in person, over the phone, or online. | 4.0/5 |

| 7. | PayJunction | PayJunction offers solutions for small and medium-sized enterprises to accept debit and credit card payments online, in-store, and on the go. | 4.7/5 |

| 8. | AmazonPay | Amazon Pay enables millions of customers worldwide to pay for goods and services using the data already recorded in their Amazon accounts. | 4.5/5 |

| 9. | Bolt | Bolt is adaptable and simple to set up, and it integrates smoothly with eCommerce platforms such as Magento, BigCommerce, and PrestaShop. | 4.6/5 |

| 10. | Braintree | Braintree allows you to use multiple payment methods and accept payment in 130 different categories, and you can easily integrate it into your online store. | 4.5/5 |

| 11. | Helcim | Helcim is recommended for all those businesses that value pricing transparency. | 4.2/5 |

Some of the best payment gateways are provided here. Rollover to check this.

1. Stripe Connect

Stripe Connect enables you to provide seamless payment integration in your software-as-a-service (SaaS) solution without going through many compliance and regulation methods. The software handles payment compliance, so you can be confident that your platform’s users will profit from a secure payment system via an easy-to-use integration.

Stripe Connect is also accessible through API integrations, which allow you to connect to your software platform easily. In addition, the solution allows you to meet all your security needs, making it easy to include payment transactions into your SaaS and marketplace products.

Features:

- Stripe can be integrated into desktop and mobile applications through APIs.

- Stripe accepts payments via bank transfers, mobile wallets, and buy now, pay later procedures.

- You don’t need a separate business account or a payment gateway.

Pricing: The charges for maintaining the account are ₹150 per monthly active account and 0.25% + ₹20 per payout.

2. PayPal

PayPal is an online payment platform that enables consumers and organizations to send and receive money securely. PayPal, when linked to your bank account, debit, or credit card, also allows you to complete e-commerce purchases. It can be accessed through the web, mobile application, or in person and acts as a mediator to protect your bank data.

Simply explained, PayPal acts as a middleman between you and a bank. When a user joins a bank account or credit or debit card to the PayPal network, they can choose which account to debit when conducting an online payment. PayPal handles all transactions instead of your bank.

Features:

- The solution provides free delivery and additional discounts on UPS and USPS shipping labels.

- As an added layer of protection, the software allows two-factor authentication and email verification for transactions.

- PayPal has many integrations to meet the needs of all types of customers, including accounting, point-of-sale systems, and reporting.

Pricing: There are no setup or monthly costs with PayPal. Transaction fees, where currency conversion is required, are 4.4% plus a set fee depending on the nation’s currency.

3. Razorpay

Razorpay payment gateway is one of the top payment solutions for Indian SMBs and online enterprises. It is a PCI-compliant payment gateway provider that also accepts international payments. Razorpay intends to provide fast and secure payment gateways for banks, schools, e-commerce, and other enterprises to receive and disburse payments online.

Razorpay simplifies payments by providing access to all common payment methods, such as debit or credit cards, UPI, internet banking, and wallets. Businesses are tempted to integrate with Razorpay payment gateways because of its developer-friendly APIs and integration options.

Features:

- Razorpay also offers lending services to help small businesses grow and lend funds to minimize cashier flow.

- RazorpayX allows businesses to manage payroll compliance, boost payouts, and access fully functional current accounts.

- Razorpay provides real-time insights and data to help you make educated business decisions.

Pricing: Razorpay charges a 2% transaction fee + GST on all transactions with Indian debit and credit cards, UPI, net banking, and mobile wallets.

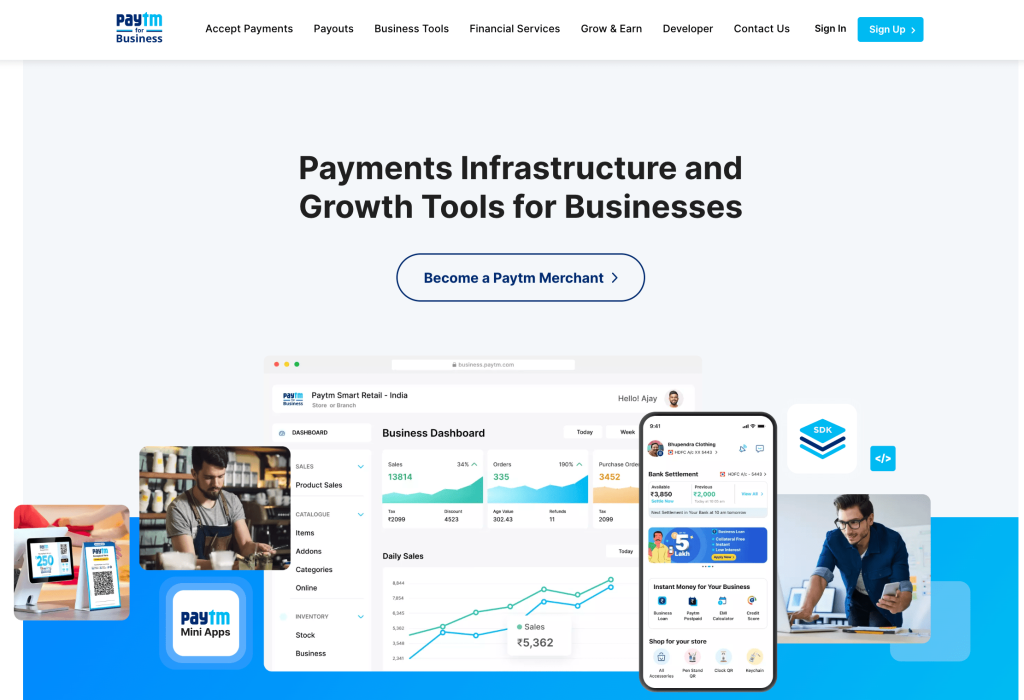

4. Paytm Payment Gateway

Paytm Payment Gateway allows users to receive payments from anybody, through any network, and from any device. The solution is based on the same software that runs some of India’s most well-known companies, including the Paytm App. The PG accepts all major payment methods, including domestic and global cards, internet banking, UPI, and mobile wallets.

Paytm Payment Gateway also works with all types of websites and apps, and it offers plugins for all major e-commerce systems, including Shopify, WooCommerce, Magento, and 20 more. The feature-rich mobile SDKs from Paytm Payment Gateway deliver the greatest checkout experience for a business’s clients.

Features:

- Payments are settled in T+1 business days by Paytm PG

- Paytm PG has the most integrations with top e-commerce websites and plugins in the industry

- Paytm Payment Gateway is secure and adheres to all safety laws. It has an SSL certificate, which ensures that users’ money is safe

Pricing: In the standard plan, the transaction fee depends on the payment method. For example, there are no costs for UPI transactions but a 1.99% fee for using credit cards.

5. Apple Pay

Apple Pay is one of the most popular touchless payment methods today. Apple Pay is well known for working with Apple devices and smartphones when purchasing in-person or online with an eCommerce retailer.

Using Apple Pay is easy and simple on an iPhone or iPad and only requires a single tap. The touchless Apple Pay gateway works with conventional credit and debit card issuers, including MasterCard, American Express, and Visa.

Features:

- Access to millions of Apple subscribers and customers who are acquainted with Apple Pay

- Customers can utilize it completely free of charge while checking out

- The capacity to provide a touchless payment mechanism, which can improve sales and, ultimately, revenue

Pricing: Using Apple Pay to sell things, services, or online downloads will cost $0.15 for every completed transaction.

6. Authorize.net

Authorize.Net is a global payment gateway with a robust infrastructure and security to enable transactional data’s easy, quick, and secure movement. Similarly to card swipes, it manages transaction routing online without requiring software installation.

It has almost 370,000 merchants throughout the world. It enables secure payment acceptance, a streamlined experience, scaling, and additional value-added capabilities. It is a fully integrated electronic payment system that receives and handles payments from different bank accounts via the user’s website or the virtual terminal of Authorize.Net.

Features:

- Supports recurring billing, i.e., monthly billing with no long-term deals

- Excellent customer service and assistance

- Accepts all major digital cards and has strong security and anti-fraud features

Pricing: Authorize.net charges $.30 per transaction and a 2.9% fee on all sales made through the gateway.

7. PayJunction

PayJunction is a payment gateway provider and merchant service that provides solutions for mid to large-scale businesses to process any sort of payment in-store or online. PayJunction’s digital signature capture and receipt capabilities provide businesses and consumers with a fully digital payment processing experience.

All transactions are saved on the PayJunction system so that users may view each client’s transaction records, and the search tool makes it easy to find archived customer data. Users can also manage their smart terminals, process checks, recharge customer data, and see reports to obtain data on the company’s performance and sales figures.

Features:

- iOS users may take keyed-in credit card payments immediately from their smartphone or tablet with PayJunction’s free mobile software

- With the help of PayJunction’s inbuilt analytics tools, you can analyze various financial data, including patterns and trends over time and transactions by payment mode.

- PayJunction is compatible with over 80 common shopping carts, including Magento and Shift4Shop.

Pricing: PayJunction employs interchange-plus charges with a 0.75% fee for all credit card transactions.

8. Amazon Pay

Amazon Pay is a payment gateway created specifically for Amazon merchants and customers. It is a simple, quick, and secure payment option that currently serves customers in eight nations. Amazon payments are divided into two categories: login and pay for customers and pay with Amazon for retailers.

This payment gateway is intended to make buying easier for both online sellers and retailers. Amazon Pay has fantastic features and tools that entice and inspire customers to spend more, streamline their purchasing experience, and improve customer loyalty and engagement through remembered payment details for speedier checkouts.

Features:

- Amazon incorporates Alexa to facilitate easy order status tracking and to increase customer happiness.

- AmazonPay supports multi-currency transactions and offers services in more than 18 countries.

- Ensures complete client protection from start to finish.

Pricing: The transaction cost consists of a 1.95% processing fee plus relevant taxes, which are levied when the transaction is successfully completed.

9. Bolt

Bolt Payments is a one-stop payment platform for online merchants. Its integrated technology distinguishes it from other checkout solutions, resulting in an optimized system designed to assist smaller online shops in competing with Amazon’s renownedly quick checkout experience.

Its rapid, low-friction checkout process is intended to enhance conversion rates and decrease the number of abandoned carts. While there are other viable quick check-out options, this product provides solid value to most online companies.

Features:

- Bolt saves manual input from your consumers during checkout by letting them save fundamental information such as payment and delivery preferences.

- Bolt also offers 100% fraud coverage, which means it will manage and cover all chargeback expenses from credit card issuers.

- Merchants may track and manage critical transactions and consumer activity data on Bolt’s consolidated dashboard.

Pricing: Bolt Payments offers pricing depending on quotes. It calculates pricing on several elements, such as your sales volume and fraud risk, before calling you to review the price.

10. Braintree

Braintree is a part of PayPal company that allows businesses to accept and process payments in different currencies, 130 to be exact. It is a rival of Stripe but much better because of its customization options. Its features include recurring billing, fraud detection, the ability to accept international payments, and 24*7 customer support. Using Braintree, you can accept payments from different payment methods.

It has a very simple pricing structure that does not charge hidden fees. You can take your business to the next level using BrainTree’s features. They also offer additional features, such as an account updater, 3D secure, and advanced fraud protection. Braintree works in 40 countries, so you can easily integrate it into your business.

Features:

- There is no contract to use Braintree, and you will have to pay no termination fees.

- Access all popular payment methods like Venmo, Pay, Apple Pay, Credit/Debit Card, ACH Direct, and Samsung Pay.

- Braintree makes the checkout process much smoother and easy for your customers.

Pricing: Braintree charges 2.59%+$0.49 per transaction for digital wallets & cards, 3.49%+$0.49 per transaction for Venmo, and 0.75% per transaction for ACH Direct.

11. Helcim

Helcim is a Canadian-based company that provides payment processing services and software to businesses of all sizes. Founded in 2006, Helcim has grown to become a leading player in the payments industry, focusing on providing transparent and affordable pricing and exceptional customer service.

Helcim’s services include credit & debit card processing, e-commerce solutions, and mobile payments. Helcim’s user-friendly platform and customizable features make it easy for businesses to accept payments online and in-person while also providing valuable insights into sales data and customer behavior.

With a commitment to ethical and responsible business practices, Helcim has earned a reputation as a trusted partner for businesses looking to streamline their payment process and improve their bottom line.

Features:

- Customizable payment forms that can be branded to match your website

- Acceptance of major credit and debit cards, as well as Apple Pay and Google Pay

- Recurring billing and subscription management capabilities

- Automated email receipts and customizable email templates

- Mobile app for processing payments on-the-go

- Reporting and analytics tools that provide insights into sales data and customer behavior

- Integrations with popular e-commerce platforms like Shopify, WooCommerce, and Magento

- Customer management tools that allow you to store customer data securely and manage recurring payments

- 24/7 customer support via phone, email, and live chat

Conclusion: Stripe is The Most Preferred!

The worldwide E-commerce market is undergoing an unprecedented transition and is on the verge of complete digital transformation. A payment gateway integrated with your online E-commerce store checkout procedure is now necessary.

As a result, it has become mandatory for all current and new E-commerce businesses to integrate one of the top payment gateways for their E-commerce store. To help you with your decision, we compiled a list and tried to provide insight into the top nine payment gateways.