My name is Henry Davis. I'm founder and CEO of arfa.

On Scaling Digital Products

So the number one thing is product-market fit. That's true of pretty much any business in the world but in D2C your feedback loops are so

quick, you can figure out product-market fit very, very quickly. Whether you have it or not and you can tweak, iterate real-time in your messaging.

Obviously takes a little longer with some of the inventory but you can still have very, very quick revolutions of change to meet customer needs as you're hearing them directly. If you land with product-market fit, that becomes very clear in the metrics quite early.

If you find that, then you've got something special and that's when you can start to take that message and broaden your reach and put some marketing dollars to work and really start to grow out your business. In order to do that you need a team that understands what it is that you're doing and understands what matters to the customer and what matters to the strategy, which can be crazy - very - exciting and very fun - but totally crazy.

On the Critical Metrics to Watch

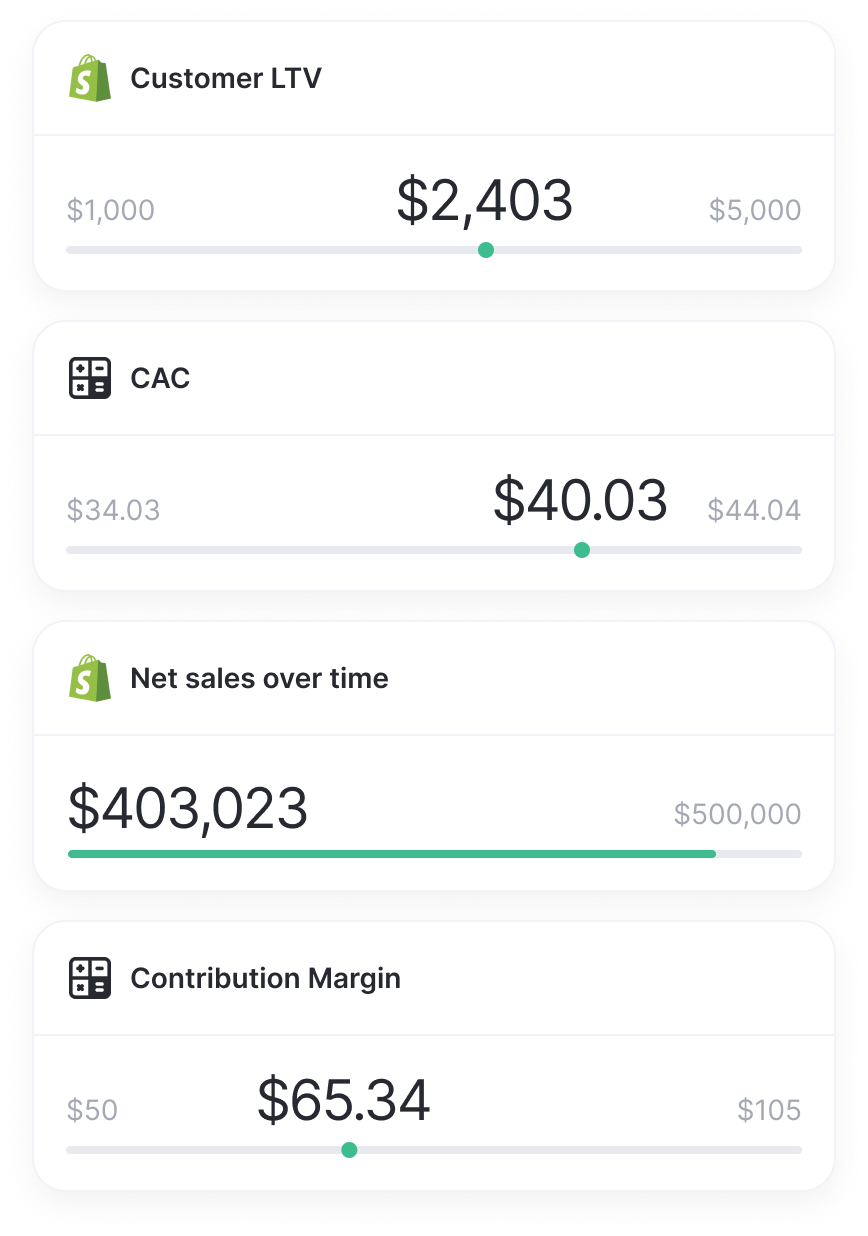

So the three things that I always used to immediately look at as an investor and continue to look at as an operator and run the business by:

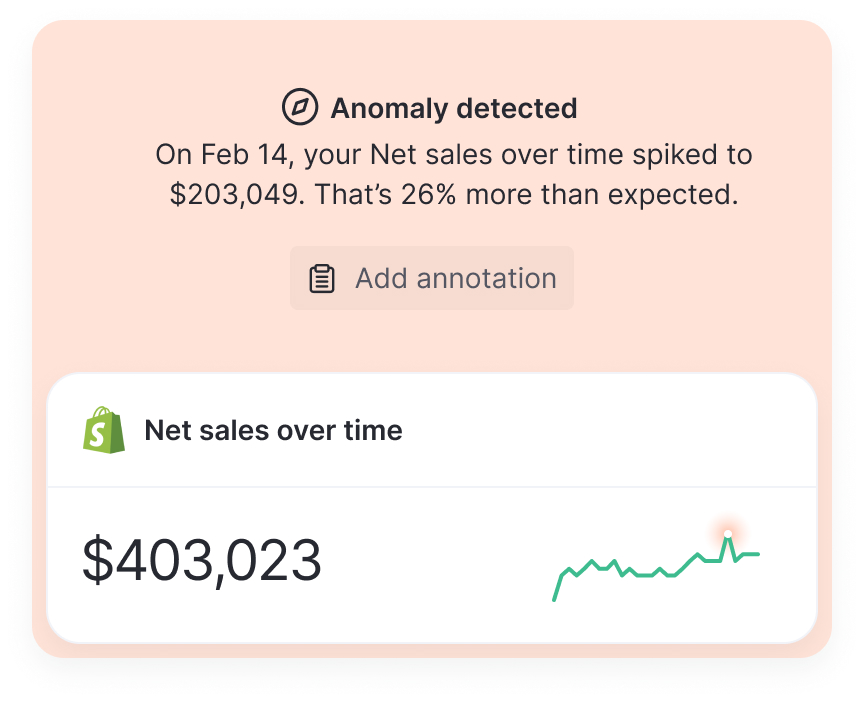

First, if I see net revenue, it seems obvious - it isn't. What is net revenue? How are you measuring it? How is it trending? How does seasonality

affect it? What are the drivers of it? All of those things really matter just to give you a baseline understanding of what it is you're dealing with.

Secondly, unit economics. Anyone can grow a business if they spend enough money, and with money so readily available in the venture-backed world at the moment, that is happening quite a lot. And a strong growth can definitely paper-over a lot of cracks. In a fundamental model for me, unit economics are absolutely key. In some other businesses sometimes it's okay to not be an economic positive on the first purchase, but then it's very important to have a clear understanding of lifetime value and be able to map very closely where your unit economic positivity happens over the lifetime.

The third thing, and in many ways, the most important thing is cohort behavior. Cohorts can get quite messy. There's lots of ways to show them,

there's lots of ugly graphs and different things you can do. I love a stacked area graph just to show cohort behavior where you layer each month on top of the previous one and you see how much revenue in a given month into growth is already baked in from previous cohorts.

And so between those three things, you get a pretty good feel for how the business is doing.

On Contribution Margins

One of the biggest challenges can be understanding the contribution margin, so gross profit minus marketing costs. Understanding what your per customer marketing costs were. You get a lot of data sources thrown at you. Mostly, they're optimized for the platform which you're paying, so I actually like to boil it down to a much, much simpler measure of "How much money did we spend and how many new customers did we get?"

And look at it at a fully blended level. It's less scientific, but I actually think it's more accurate. You can spend a lot of time building very complex models for very imprecise data, I should say.