As a seller on Amazon FBA, it’s crucial to remain informed about the latest trends and developments in the industry.

By staying up-to-date with the latest statistics for Amazon FBA sellers, you can make better-informed business decisions that will help you increase your sales and profits.

I have compiled the most significant statistics of Amazon FBA, from the number of Amazon FBA sellers to the Amazon marketplace, in this article.

Without any further delay, let’s get into it.

Amazon FBA Statistics: Top Picks (2024)

Explore vital Amazon FBA stats, revealing insights into its growth, sales, and impact on e-commerce. Data-driven analysis within.

- Amazon has 9.7 million sellers globally.

- 94% of the sellers make use of Amazon’s FBA service.

- 22% of Amazon sellers use a combination of FBA and their own handling of orders.

- 73% of Amazon sellers in the United States use FBA.

- Amazon generated $127.4 billion in revenue in the first quarter of 2023.

- Brazil is the fastest-growing global Amazon marketplace as of 2023, with more than 220% of year-over-year growth.

- Facebook is the trending social media platform among Amazon sellers, with 67% of them using it for advertisement in 2023.

- There are 200 million Amazon Prime members worldwide.

- Home and Kitchen is the top category on Amazon by revenue, which generated $28.1 billion in revenue last year.

- Amazon is the second most used app in the United States, with 98 million monthly active users.

Also Read: Want to learn step-by-step how to launch an Amazon FBA private label business Check our detailed guide here.

How Many Sellers Use Fulfilment By Amazon (FBA) In 2024?

The number of Amazon FBA users is snowballing. This section will provide essential statistics regarding the number of Amazon FBA sellers.

- 94% of Amazon sellers use FBA globally.

FBA is an excellent option for sellers starting in the eCommerce industry who haven’t yet figured out their fulfillment logistics.

The concept is straightforward – you sell your products, and Amazon handles the shipping.

- 22% of sellers use a combination of FBA and their own handling of orders.

The fulfilled-by-Amazon (FBA) model became popular in 2022, with 64% of merchants using Amazon’s logistics to fulfill their orders.

Meanwhile, 22% of merchants used a combination of FBA and their own handling of orders, which includes storage, shipping, and customer service.

Source: Seller App, Statista.

Amazon FBA Usage By Country

The percentage of Amazon FBA sellers varies across countries. According to the most recent data from December 2018, there are significant differences in Amazon FBA usage by country.

This section will explore the critical statistics on Amazon FBA usage by country.

- 73% of sellers used FBA in the United States.

The United States is a leading country for FBA usage by sellers.

Spain ranks second with 61% usage.

The table displays the top countries with the highest FBA seller usage.

| Country | Share Of Sellers Who Use FBA |

| The United States | 73% |

| Spain | 61% |

| Italy | 57% |

| Canada | 65% |

| Japan | 55% |

| France | 51% |

| Germany | 46% |

| The United Kingdom | 45% |

| India | 47% |

| Australia | 33% |

Source: Statista.

Amazon Seller Statistics

This section will present you with comprehensive statistics about Amazon sellers.

- Amazon has 9.7 million sellers globally as of 2023.

However, only 1.9 million are currently active, which accounts for just under 20%.

- Sellers sell 341 million products on Amazon.

Amazon offers a wide variety of products, but only 3.5% of them come from Amazon itself.

The vast majority of products – 96.5%, to be exact – are offered by sellers who are affiliated with the site.

- 17% of sellers make less than $500/month by selling on Amazon.

A significant percentage of Amazon sellers (70%) earn more than $1,000 monthly.

One in four (25%) sellers make over $25,000 monthly sales.

This table shows the share of Amazon sellers based on their monthly income:

| Monthly Sales | Share Of Sellers |

| Less than $500 | 17% |

| $501 to $1,000 | 10% |

| $1,001 to $5,000 | 17% |

| $5,001 to $10,000 | 12% |

| $10,001 to $25,000 | 16% |

| $25,001 to $50,000 | 12% |

| $50,001 to $100,000 | 8% |

| $100,001 to $250,000 | 5% |

| $251,000 to $500,000 | 1% |

- 3% of Amazon sellers’ profit margin is between 51% to 100%.

The profit margin for majority of Amazon sellers falls between 16% to 20%.

However, 8% of sellers are yet to become profitable.

For a comprehensive overview of the profit margins for Amazon sellers, please refer to the table below.

| Profit Margin | Share Of Amazon Sellers |

| 1% to 5% | 9% |

| 6% to 10% | 10% |

| 11% to 15% | 15% |

| 16% to 20% | 18% |

| 21% to 25% | 13% |

| 26% to 50% | 16% |

| 51% to 100% | 3% |

| Not Yet Profitable | 8% |

| Unknown | 8% |

- Amazon’s market share is 37.8% in the e-commerce market.

Amazon is a leading player in the e-commerce market, especially in the United States.

Amazon holds 37.8% of the market share in the United States, while the second place is held by Walmart with a share of 6.3%.

- 80% of Amazon sellers also sell their products on other platforms.

Although many individuals sell products on Amazon, most do not depend solely on this platform for their income.

37% of Amazon sellers have full-time jobs outside of selling on Amazon.

- Only 1 % of Amazon sellers have made their lifetime sales between $10 million to $50 million.

According to recent data, many Amazon sellers (43%) have reported total lifetime sales of less than $25,000.

Nonetheless, there are also a considerable number of sellers who have exceeded this amount.

A table shows Amazon sellers by lifetime sales.

| Sales | Share Of Sellers |

| Less than $25K | 43% |

| $25K to $50K | 11% |

| $50K to $100K | 10% |

| $100K to $500K | 14% |

| $500K to $1 Million | 6% |

| $1 Million to $5 Million | 7% |

| $5 Million to $10 Million | 2% |

| $10 Million to $50 Million | 1% |

- 58% of Amazon sellers are aged between 24 to 44 years old.

It’s interesting to note that a large portion of Amazon sellers, around 1 in 6, are between 24 to 44 years old.

Furthermore, most Amazon sellers are male, constituting 72% of all sellers as of 2023.

Additionally, it’s worth mentioning that half of Amazon sellers have jobs outside of their e-commerce businesses, whether part-time or full-time.

- Every day, 3,700 sellers join Amazon.

Every month, 111,000 new sellers sign up to sell on Amazon, resulting in a yearly addition of 1 million new Amazon sellers.

- 13% of sellers generated 61% to 80% of their revenues from Amazon Sales.

This statistic shows how much of the total e-commerce revenue comes from sales on Amazon, as reported by Amazon sellers.

Almost half of all businesses said that Amazon sales accounted for 81% to 100% of their revenues.

A table shows the sellers generate their revenues from Amazon Sales.

| The Percentage Of Revenue Generated from Amazon Sales | Share Of Sellers |

| 81% to 100% | 47% |

| 61% to 80% | 13% |

| 41% to 60% | 10% |

| 21% to 40% | 12% |

| 1% to 20% | 18% |

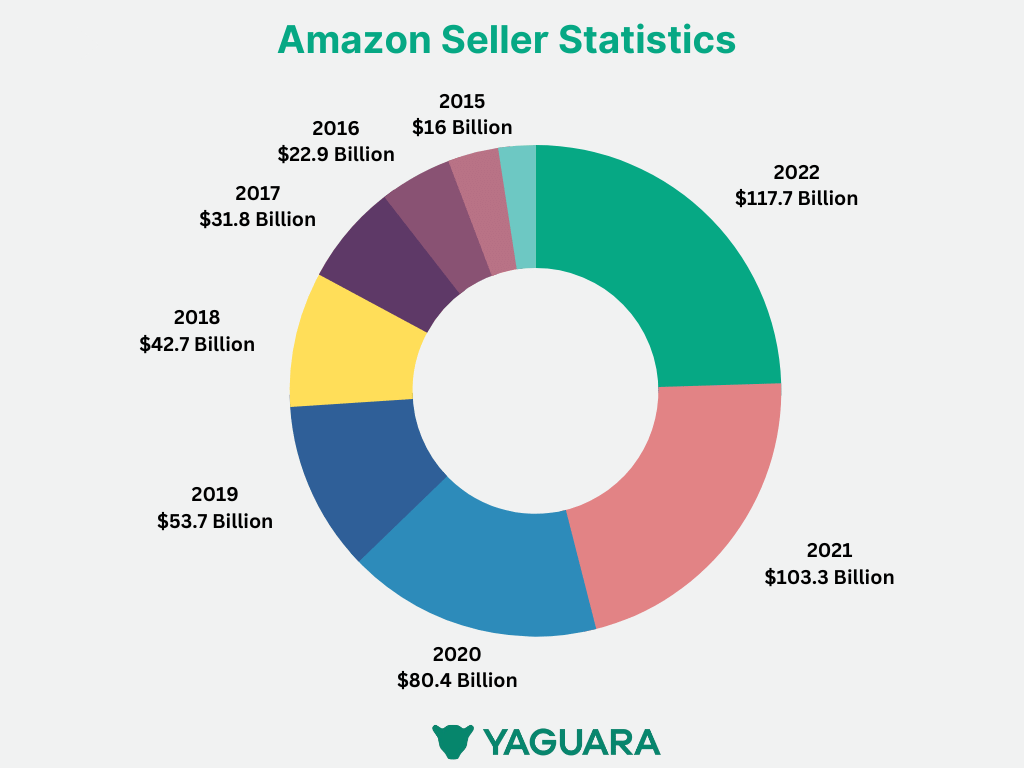

- Amazon generated $117.7 billion in revenue from its third-party sellers in 2022.

The third-party seller’s revenue increases every year. In 2021, the third-party revenue was $103.3 billion.

This table shows the complete insights into Amazon’s third-party seller revenue over the years:

| Year | Third-Party Seller Revenue |

| 2022 | $117.7 billion |

| 2021 | $103.3 billion |

| 2020 | $80.4 billion |

| 2019 | $53.7 billion |

| 2018 | $42.7 billion |

| 2017 | $31.8 billion |

| 2016 | $22.9 billion |

| 2015 | $16 billion |

| 2014 | $11.7 billion |

- 49% of Amazon sellers’ motivation is to be their own boss.

People choose to start an online business on Amazon for several reasons or motivations.

Nearly half of the sellers surveyed stated that they wanted to be their own boss.

The second most common motivation was the desire for flexibility to work from anywhere or travel, with 47% of respondents indicating this as a reason for starting their online business.

The table below highlights Amazon sellers’ top motivations for starting a business on the platform.

| Motivation | Share Of Respondents |

| To be my own boss | 49% |

| Flexibility to work anywhere/travel | 47% |

| To feel successful/accomplished | 39% |

| Extra Income (on top of existing income) | 38% |

| New Income (to replace current Income) | 34% |

| A challenge | 29% |

| Professional Achievement | 23% |

| To sell a business to an investor | 22% |

| New Income (Had little/no prior income) | 19% |

| Job change (Dislike the previous job) | 13% |

| A hobby | 12% |

| A new Sales channel for my existing Business | 9% |

Source: Jungle Scout, Trueprofit.

Amazon Sales Statistics

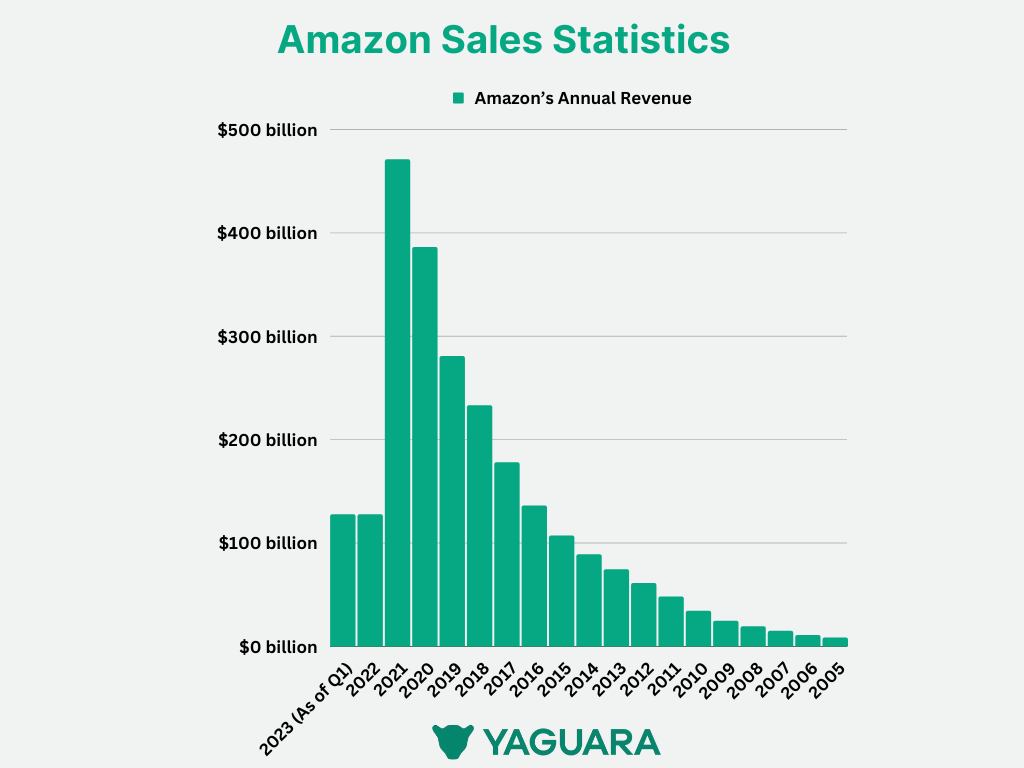

In 2022, Amazon surpassed the $500 billion mark in revenue. Each year, Amazon continues to reach new milestones in terms of revenue.

This section provides a comprehensive insight into Amazon’s sales statistics.

- Amazon generated $127.4 billion in revenue in the first quarter of 2023.

In Q1 of 2023, Amazon experienced a slight decrease in revenue, around $21.8 billion lower than the fourth quarter of 2022.

Amazon projects revenue of $127 billion to $133 billion for Q2 of 2023.

Please refer to the table below for a comprehensive overview of Amazon’s revenue by quarter.

| Quarter | Amazon Revenue |

| Q1 of 2023 | $127.4 million |

| Q4 of 2022 | $149.2 million |

| Q3 of 2022 | $127.1 million |

| Q2 0f 2022 | $121.23 million |

| Q1 of 2022 | $116.44 million |

| Q4 of 2021 | $137.41 million |

| Q3 of 2021 | $111.81 million |

| Q2 0f 2021 | $113.08 million |

| Q1 of 2021 | $108.51 million |

| Q4 of 2020 | $125.55 million |

| Q3 of 2020 | $96.14 million |

| Q2 0f 2020 | $88.91 million |

| Q1 of 2020 | $75.45 million |

| Q4 of 2019 | $87.43 million |

| Q3 of 2019 | $69.98 million |

| Q2 0f 2019 | $63.4 million |

| Q1 of 2019 | $59.7 million |

| Q4 of 2018 | $72.38 million |

| Q3 of 2018 | $56.57 million |

| Q2 0f 2018 | $52.88 million |

| Q1 of 2018 | $51.04 million |

- In 2022, Amazon’s total revenue was $513.9 billion.

In 2022, Amazon achieved a significant milestone by surpassing $500 billion in revenue, representing an increase of $43.1 billion from the previous year.

In 2021, Amazon generated $470.8 billion in revenue.

Please refer to the table below for Amazon’s annual revenue from 2005 to 2023.

| Year | Amazon’s Annual Revenue |

| 2023 (As of Q1) | $127.4 billion |

| 2022 | $513.9 billion |

| 2021 | $470.8 billion |

| 2020 | $386 billion |

| 2019 | $280.5 billion |

| 2018 | $232.8 billion |

| 2017 | $177.8 billion |

| 2016 | $135.9 billion |

| 2015 | $107 billion |

| 2014 | $88.9 billion |

| 2013 | $74.4 billion |

| 2012 | $61 billion |

| 2011 | $48 billion |

| 2010 | $34.2 billion |

| 2009 | $24.5 billion |

| 2008 | $19.1 billion |

| 2007 | $14.8 billion |

| 2006 | $10.7 billion |

| 2005 | $8.4 billion |

- Amazon’s $220 billion revenue came from online stores in 2022.

Amazon generates most of its revenue from online stores.

Amazon earned $222 billion from online stores in 2021.

The table below provides a detailed breakdown of Amazon’s online store revenue over the years:

| Year | Amazon’s Online Store Revenue |

| 2022 | $220 billion |

| 2021 | $222 billion |

| 2020 | $197.2 billion |

| 2019 | $141.2 billion |

| 2018 | $122.9 billion |

| 2017 | $108.3 billion |

| 2016 | $91.4 billion |

| 2015 | $76.8 billion |

| 2014 | $68.5 billion |

- Amazon recorded $80 billion in revenue from AWS in 2022.

Amazon has a variety of revenue sources, including physical stores, AWS, and subscription services.

In 2022, AWS, subscription services, and physical stores generated $80 billion, $35.2 billion, and $18.9 billion in revenue, respectively.

A table provides a complete overview of the revenue generated by Amazon’s AWS, subscription services, and physical stores from 2017 to 2022.

| Year | AWS Revenue | Subscription Services Revenue | Physical Stores Revenue |

| 2022 | $80 billion | $9.7 billion | $18.9 billion |

| 2021 | $62.2 billion | $14.1 billion | $17 billion |

| 2020 | $45.3 billion | $19.2 billion | $16.2 billion |

| 2019 | $35 billion | $25.2 billion | $17.1 billion |

| 2018 | $25.6 billion | $31.7 billion | $17.2 billion |

| 2017 | $17.4 billion | $35.2 billion | $5.8 billion |

- Amazon’s most revenue comes from the North American region, with $279.8 billion in 2021.

Over half of Amazon’s revenue comes from the North American region annually.

In 2006, Amazon collected only $5.6 billion in revenue from North America, reaching $279.8 billion in 2021.

A table shows Amazon’s revenue collected from the North American region from 2006 to 2021.

| Year | Revenue |

| 2021 | $279.8 million |

| 2020 | $236.2 million |

| 2019 | $170.2 million |

| 2018 | $141.3 million |

| 2017 | $106.1 million |

| 2016 | $79.7 million |

| 2015 | $63.7 million |

| 2014 | $50.8 million |

| 2013 | $44.5 million |

| 2012 | $34.8 million |

| 2011 | $26.7 million |

| 2010 | $18.7 million |

| 2009 | $12.8 million |

| 2008 | $10.2 million |

| 2007 | $8.1 million |

| 2006 | $5.6 million |

Source: Business of Apps.

Amazon Marketplace Statistics

Amazon is one of the largest marketplaces. In this section, we will gather all the essential statistics related to the Amazon Marketplace.

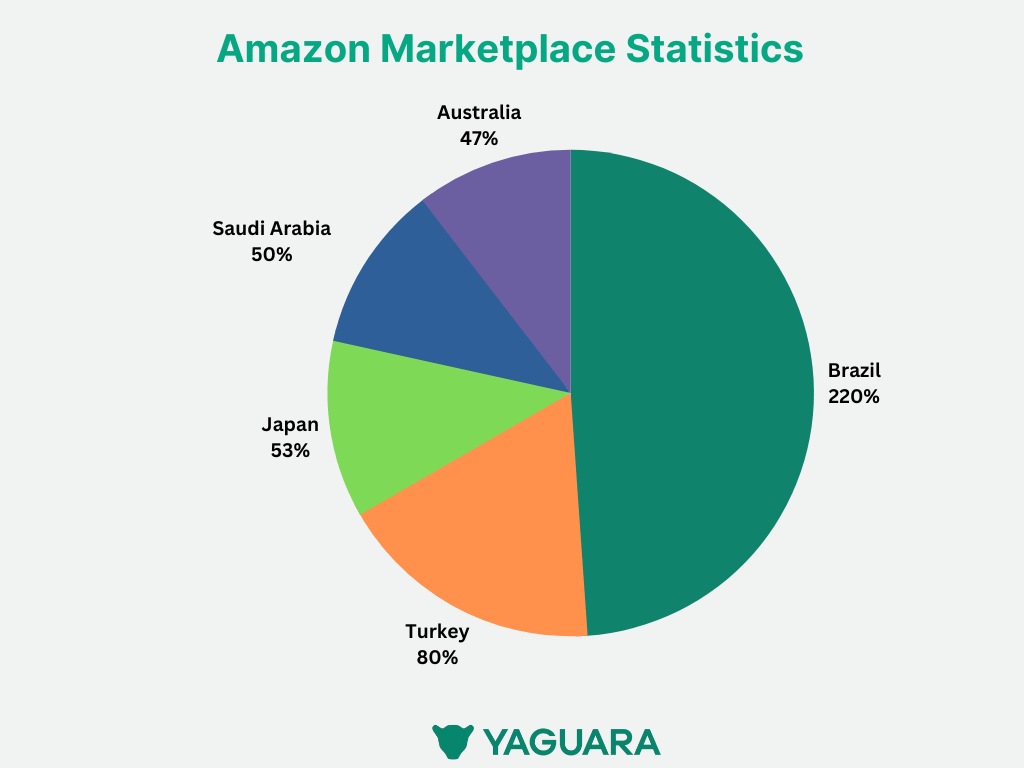

- Brazil is the fastest-growing global Amazon marketplace as of 2023, with more than 220% of year-over-year growth.

Turkey is The second fastest-growing global Amazon marketplace, with 80% of year-over-year growth.

A table shows here the fastest-growing global Amazon Marketplaces.

| Fastest Growing Marketplaces | Year-Over-Year Growth |

| Brazil | 220% |

| Turkey | 80% |

| Japan | 53% |

| Saudi Arabia | 50% |

| Australia | 47% |

- In 2022, 61% of Amazon sellers were found to be selling their products on at least one other channel.

In 2022, 61% of Amazon sellers were found to be selling their products on at least one other channel, an increase from the previous year’s figure of 58%.

Moreover, over half of them plan to explore new ecommerce platforms and global marketplaces this year.

Along with these organic growth strategies, one in three sellers is focused on acquiring other ecommerce brands, indicating the industry’s overall confidence in its future.

- Third-party sellers contributed 59% of all marketplace sales in the fourth quarter of 2022.

Third-party sellers are responsible for most sales on the Amazon marketplace. In Q4 of 2022, they made up 59% of all marketplace sales, steadily increasing from 51% at the end of 2017.

This table shows complete insight into the share of third-party sellers of all marketplace sales.

| Fourth Quarter Of The Year | Share Of Third-Party Sellers Of All Marketplace Sales |

| Q4 of 2022 | 59% |

| Q4 of 2021 | 56% |

| Q4 of 2020 | 55% |

| Q4 of 2019 | 53% |

| Q4 of 2018 | 52% |

| Q4 of 2017 | 51% |

Source: JungleScout.

Amazon Advertising Statistics

Amazon sellers promote their products on various platforms, including social media and search engines.

In this section, I have gathered essential statistics about Amazon advertising that will assist you in developing your advertising strategy.

- 59% of Amazon sellers advertise their products the most on e-commerce platforms.

E-commerce platforms such as Amazon PPC and Walmart sponsored are the preferred choice for many Amazon sellers to promote their products.

Note: Here is a complete article on the best e-commerce platforms, please check this out for more details.

However, in 2023, 4% of Amazon sellers did not advertise their products on the e-commerce platform promoted in 2022.

The second most popular advertising platform to promote products is social media, including paid Facebook Ads or organic Instagram content, which 41% of Amazon sellers used in 2023.

Note: If you’re interested in reading more information on social media marketing statistics, this article is a great resource to check out.

A table shows the advertising platforms utilized by Amazon sellers to promote their products in 2023.

| Advertising Platform | Sellers Use In 2023 | Sellers Used In 2022 |

| E-commerce Platforms | 59% | 63% |

| Social Media | 41% | 36% |

| Search Engines | 29% | 23% |

| Traditional Media | 4% | 4% |

- Facebook is the trending social media platform among Amazon sellers, with 67% of them using it for advertisement

While 55% of Amazon sellers used Instagram ads in 2022, that number decreased to 49% in 2023.

In addition, more than half of Amazon sellers plan to use social media influencers for advertising in 2023.

Below is a table showing the percentage of Amazon sellers using various social media platforms for advertising in 2023.

| Sellers Use Social Media Platforms For Advertisement | Share Of Sellers Using It |

| Facebook Ads | 67% |

| Instagram Ads | 49% |

| YouTube Ads | 29% |

| Pinterest Ads | 15% |

| TikTok Ads | 31% |

| Snapchat Ads | 4% |

- Amazon generated $37.7 billion in revenue from advertising in 2022.

Amazon’s advertising revenue has continued to increase since 2020. In 2022, Amazon’s advertising revenue increased by $6.5 billion as compared to 2021.

Overall, it is clear that Amazon’s advertising revenue has been on a steady upward trend, with significant growth between 2021 and 2022.

Here is a complete breakdown of the revenue from 2020 to 2022.

| Year | Advertising Revenue Of Amazon |

| 2022 | $37.7 billion |

| 2021 | $31.1 billion |

| 2020 | $15.5 billion |

Source: JungleScout.

Amazon Prime Statistics

An Amazon Prime membership offers a variety of benefits, including a fast delivery option. In this section, we’ll cover the essential statistics related to Amazon Prime.

- There are 200 million Amazon Prime members worldwide as of 2023.

As of Q1 of 2023, the number of people enrolled in Amazon Prime has exceeded 200 million, with 163.5 million members in the United States.

An estimated 67% of United States households will have a Prime membership by the end of 2022, while Prime members currently represent more than 74% of all Amazon customers in the United States.

A table shows the number of Amazon Prime members from 2017 to 2023.

| Year | Amazon Prime Members |

| 2023 | 200 million |

| 2022 | 163.5 million |

| 2021 | 148.6 million |

| 2020 | 142.5 million |

| 2019 | 124 million |

| 2018 | 112.1 million |

| 2017 | 99.7 million |

- Around 74.3% of Amazon Prime members are in the United States.

Amazon Prime boasts an impressive membership base of over 200 million worldwide, with 148.6 million members residing in the United States alone.

Other countries with notable Amazon user populations include Japan, the United Kingdom, and Germany.

- 76.6% of households in the United States had Amazon Prime Memberships in 2022.

It’s worth noting that almost two-thirds of all households in the United States are Amazon Prime members.

This represents a significant increase of 27% from 2018 when 60.1 million families in the country had Prime memberships.

A table shows the percentage of households with Amazon Prime membership over the years.

| Year | The Percentage Of Households With Amazon Prime Membership |

| 2018 | 60.1% |

| 2019 | 66.4% |

| 2020 | 71.3% |

| 2021 | 74.4% |

| 2022 | 76.6% |

- Amazon Prime members spend an average of $1,968 yearly on Amazon in the United States.

Amazon Prime members exhibit a high degree of loyalty to the brand, spending four times more annually compared to non-Prime members on average.

- 7% of Amazon Prime members buy the product once per day in the United States.

The frequency of buying products on Amazon varies by membership. Amazon Prime members buy from Amazon more often a week or once per week. ‘

20% of Amazon Prime Members buy products from Amazon a few times per week, while only 3% of non-prime members buy products a few times per week.

The table below shows the frequency of Prime and Non-prime Members buying products from Amazon.

| Frequency | Prime Members | Non-Prime Members |

| Once per day | 7% | 2% |

| A few times per week | 20% | 3% |

| Once per week | 21% | 8% |

| Every few weeks | 26% | 21% |

| Once per month | 14% | 22% |

| Every few months | 11% | 37% |

Source: Zippia, Amzcout.net.

Amazon’s Top Categories

In this section, I’ve gathered all the key statistics related to Amazon’s top categories regarding revenue, product views, and units sold, among other metrics.

- Home and Kitchen is the top category on Amazon by revenue, which generated $28.1 billion in revenue in 2022.

Amazon offers shoppers a diverse selection of categories, making it a convenient one-stop shop for all their eCommerce needs.

The second most popular category, Electronics, generated a revenue of $18.7 billion.

Below is a table displaying the top Amazon categories.

| Top Amazon Category | Revenue |

| Home & Kitchen | $28.1 billion |

| Electronics | $18.7 billion |

| Clothing, Shoes & Jewelry | $17.1 billion |

| Health & Household | $13.6 billion |

| Tools & Home Improvement | $11.6 billion |

| Sports & Outdoors | $10.3 billion |

| Patio, Lawn & Garden | $10.1 billion |

| Beauty & personal care | $9.2 billion |

| Grocery & Gourmet Food | $8.4 billion |

| Toys & Games | $7.5 billion |

- Grocery and Gourmet Food is the top category by unit sold, with 742.6 million units.

In comparing the performance of categories based on units sold, it can be observed that Clothing, Shoes, and Jewelry ranks second with 657.2 million units sold, despite being third in revenue on the list.

On the other hand, Home and Kitchen rank first in revenue but third in units sold, with 656.9 million.

Refer to the table for the top Amazon categories based on units sold.

| Top Amazon Category | Unite Sold |

| Grocery & Gourmet Food | 742.6 million |

| Clothing, Shoes, and Jewelry | 657.2 million |

| Home & Kitchen | 656.9 million |

| Health & Household | 598.2 million |

| Beauty & Personal care | 462.9 million |

| Electronics | 247.3 million |

| Tools & Home Improvement | 241.7 million |

| Toys & Games | 234.4 million |

| Sports & Outdoors | 193.4 million |

| Patio, Lawn, and Garden | 144.6 million |

- Clothing, Shoes, and Jewelry is the top Amazon category by view.

Based on Amazon search data, the two most popular product categories are Clothing, Shoes, & Jewelry and Home & Kitchen, with 8.3 billion and 7.0 billion views, respectively.

Electronics is the third top category, with 5 billion views.

Please refer to the table below for the top Amazon categories by product view.

| Top Category | Product Views |

| Clothing, Shoes, & Jewelry | 8.3 billion |

| Home & Kitchen | 7 billion |

| Electronics | 5 billion |

| Tools & Home Improvement | 3.2 billion |

| Sports & Outdoor | 3 billion |

| Health & Household | 2.8 billion |

| Beauty & Personal Care | 2.4 billion |

| Toys & Games | 1.8 billion |

| Patio, Lawn & Garden | 1.7 billion |

| Grocery & Gourmet Food | 1.6 billion |

Source: Similar Web, Zippia.

Why Do People Shop On Amazon?

There are numerous reasons why customers prefer to shop on Amazon. Let’s look at some of the most important statistics regarding this choice.

- 80% of shoppers say free and fast shipping is their top reason to shop from Amazon.

Amazon offers so much to its customers, which is why it is such a popular choice for shopping.

According to a Statista report, many customers cited the following reasons as the most impactful:

| Reasons To Buy From Amazon | Share Of Respondents |

| Free and Fast Shipping | 80% |

| Wide selection of products | 69% |

| Desire to use Prime membership | 66% |

| Best prices on products | 49% |

| Easy returns | 44% |

Source: Statista.

General Amazon Statistics

Below are some of the key statistics about the Amazon platform that will help you better understand the details of this article.

Take a look:

- Amazon has 310 million users globally.

Amazon has an incredibly vast user base. To put it in perspective, the number of Amazon users surpasses the total population of Indonesia, which is currently the fourth most populous country in the world.

- Amazon has 2.72 billion monthly visitors.

Amazon’s e-commerce market receives over twice as many visits per month compared to the second most popular market, eBay, which has 885 million visits.

Walmart falls even further behind with just over 410 million visits.

- Amazon is the second most used app in the United States, with 98 million monthly active users.

The Amazon app is widely used in the United States, with its users coming in second only to Walmart.

However, with Walmart’s app currently boasting 120 million monthly active users, it is evident that Amazon is rapidly closing the gap.

- Amazon ships 18.5 orders every second.

Amazon processes and ships new orders continuously.

With 18.5 orders per second, that amounts to 66,000 orders every hour and 1.6 million shipped daily.

- 66% of consumers start their new product searching on Amazon.

There are many platforms where consumers start their search for new products. But most of the customers go to Amazon.

The second top product-searching platform is a Search Engine, where 20% of people go for product search.

A table shows the complete insight into the product search platform.

| Product-Search Platforms | Share Of Respondents |

| Amazon | 66% |

| Search Engine | 20% |

| Brand Website | 4% |

| Retailer Website | 4% |

| Social Media | 1% |

| Other Marketplaces | 3% |

| Others | 1% |

Source: Zippia, Amzscout.net.

Related Read:

Conclusion: Amazon FBA Statistics (2024)

Using FBA to sell your products can add an extra benefit to your business.

An ecommerce company that signs up with Amazon FBA gets all services from Amazon, including shipping, returns, refunds, warehousing, and picking and packaging management.

Amazon FBA adapts to meet customer and vendor demands. By managing sales and keeping products in stock, day-to-day operations are assured.

For more updates, keep revisiting this article. We will be updating it from time to time.

FAQs

About 46% of Amazon sellers achieve an average Amazon FBA success rate of 11-25%.

Profit depends on sales, product quality, and price. According to JungleScout, half of Amazon sellers make $12,000 to $300,000 annually, which equals $1,000 to $25,000 in monthly sales on average.

In 2021, more than 60,000 sellers in Amazon’s marketplaces worldwide made over $1 million in sales, doubling the number from three years ago. This growth is impressive.

Profit depends on what you sell, the quality of your listings, and the price. Almost half of Amazon sellers earn $1,000 to $2,500 monthly, making it a lucrative opportunity.

No, Amazon FBA is not free. Amazon FBA costs depend on your chosen plan. You can select the Individual selling plan for a flat rate of $0.99 per item sold or the Professional selling plan for $39.99 monthly.